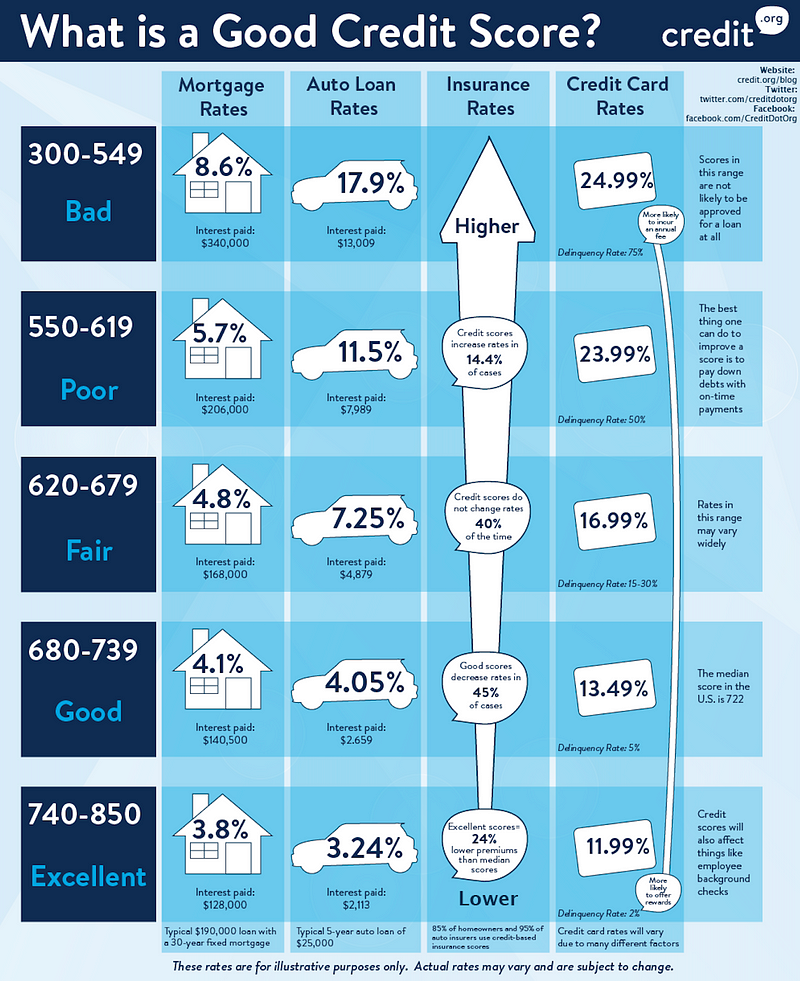

A good credit score is essential for purchasing a new place, a new car, or taking out a loan with better interest rates — but what factors go into the number?

No Single Number

First, there is no definite credit score — there are different credit score models. The credit reporting agencies TransUnion, Experian, and Equifax together give the VantageScore. The FICO score is another well-known and widely accepted model that was introduced in 1989. Creditors use the FICO score to evaluate past credit use for lending decisions.

Factors of the FICO Score

According to the FICO website, the score pulls from five different categories: payment history, amounts owed, length of credit history, new credit, and credit mix.

Payment History (35%)

This is the most important category — it looks at if you have made your credit payments on time. The score in other words reflects your trustworthiness and timeliness. Repeated late payments will damage your score.

Amounts Owed (30%)

This looks at how much of your available credit you are using. By standard, using about 30% is recommended. For example, if you have a $1,000 credit limit, try to use around $300.

Length of Credit History (15%)

This factor looks at how long you have held your credit accounts. The longer, the better — but if you have an old credit account that you have made many late payments on, that will not reflect well on your score.

This category also explains why many people are encouraged to start a credit card as early as possible — especially if you are a college student.

New Credit (10%)

When you open a new credit account, it will decrease your score temporarily, for up to six months. Making new credit accounts however is not discouraged. Rather, you should not be opening too many in a short period of time.

Credit Mix (10%)

The credit mix looks at the different types of accounts you hold: credit cards, loans, and more. Credit cards are considered revolving accounts, where payments are made monthly and are flexible. Installment accounts like mortgage loans are fixed monthly payments. If you prove your responsibility to manage both, it will reflect well on your overall credit score.

The biggest takeaway should be that above all, timely payments are significant in increasing your credit score. You can set up autopay functions like many credit card accounts offer, or set monthly reminders on your phone to manually make the payments.

Although different credit scores have different calculations, these factors overall remain important across the board. Knowing these different factors will help you guide your decisions on credit spending, and opening new accounts.