For better or worse, one of the most important metrics in your financial life is your credit score. Most Americans aren’t well informed of this in their traditional upbringing and as a result are left playing catch-up later in life or simply don’t understand some of the core benefits of having a high credit score.

This 3-digit number can either cost you or save you hundreds of thousands of dollars over the course of your lifetime and the sooner you can get ahead of it the more beneficial it will be for your life.

Here are 5 of the best ways we at TomoCredit recommend to best improve your credit score

- Create accounts and monitor your credit scores frequently

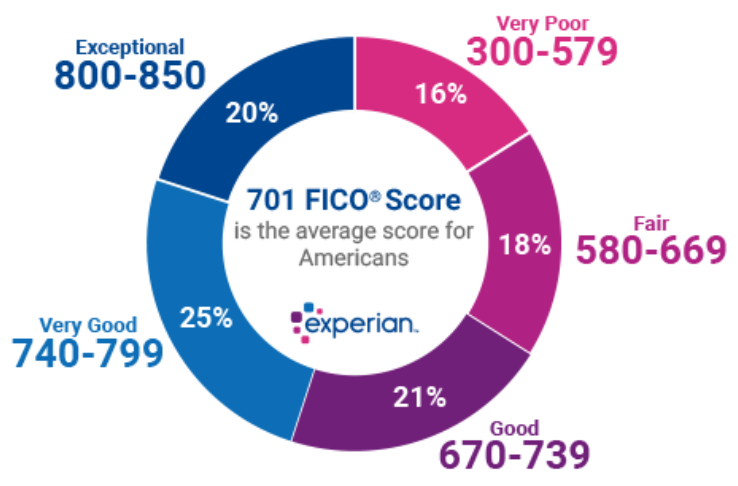

Improving your credit score starts with knowing what it exactly is. We recommend creating accounts on at least two of the major credit card portals including Credit Karma, Credit Sesame, Credit.com, Quizzle, and WalletHub. You can also create an account on AnnualCreditReport.com where you can check your credit report for free once every 12 months from each of the major credit bureaus — Equifax, Experian, and TransUnion. See the below graph (from Experian) for an idea of what the average American credit score is and what ranges are considered good — bad scores.

From Experian

2. Pay your bills on time

Get this tattooed, carve it in stone, or repeat it over and over again until it’s memorized. This is probably the easiest way for an individual to steadily build their credit score over time but is also the most abused. It’s simple and straightforward yet millions of Americans take liberties with their credit card spending and let their credit payments carry over consecutive months and damaging their credit scores. Inherently credit scores are a reflection of your ability to pay off debts over time signaling your reliability. You can positively influence this indicator by using calendar reminders or setting your bills on auto-pay to help ensure you pay on time every month. Paying your bills late or settling your debts for less than what you agreed on will negatively affect your score.

3. Keep your balances low

An important part of today’s credit scoring systems is your credit utilization ratio. This ratio is calculated by looking at the credit balances you have across all your cards at a given time and dividing that by the total credit limit you have across all of your credit cards. What you are left with is a ratio that has a significant weight to your total credit score. Lenders look for credit ratios of 30% or less, so your credit utilization ratio should fall below this number in order for it to have a positive impact on your score. Example: if you typically have $1k a month in credit balances and your total credit limit across your cards is $5k then your credit ratio is 20%.

Best way to improve your credit utilization ratio, and as a result your credit score, is to keep your overall balances low! On this note if you have unused cards we recommend not closing these accounts as long as you aren’t paying costly fees. The additional credit limits will help your credit utilization ratio as long as you keep the account open but just don’t spend on them.

4. Avoid too many hard credit inquiries and don’t open more accounts than you need

Applying for loans or new credit cards will result in hard inquiries which can take a negative toll on your credit score and remain on your record for 2 years. This can ultimately be mitigated over time but requires careful overview. If you already have cards open be smart about which accounts you utilize and avoid closing credit lines if you don’t need to. At the same time however don’t open new credit cards if you don’t need them and put your spending habits at risk.

5. Start building and proactively maintaining your credit score as early as possible

The toughest part of starting to build your credit history is not having one at all. At some point you’ll need to qualify for a credit card and start building up a balance with regular payments to show future creditors and lenders that you are a trustworthy borrower. Not many cards will take chances on immigrants or even young professionals. This is where we at TomoCredit hope to help empower folks towards building a healthier credit history. Our card uses alternative evaluation methods compared to traditional card providers to ensure that you can get a card that will serve you with high rewards and put you on the path to financial success.

Follow @TomoCredit on Twitter and Instagram and sign up for our wait-list today at www.tomocredit.com to receive your own card.